Gun Barrel EDC holds Town Hall on Pier 334

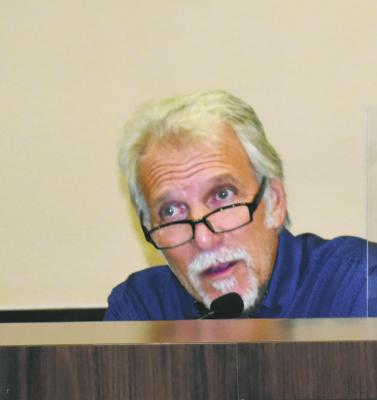

Monitor Photo/Denise York

Developer Steven Haynes answers questions concerning the project and his company.

GUN BARREL CITY–This is part II of the town hall meeting held June 2. Part I ran in The Monitor Thursday, June 8. We pick up with Developer Steven Haynes’ discussion of the project and answers to questions put to him by the public.

As a reminder, Haynes is CEO of Haynes Investments and as a Manager of YNS Services, his role is mainly in facilitating financing for the projects. This information appeared in part I.

The first question referred to social media posts saying that YNS was involved in a class action lawsuit. Haynes clarified that YNS was never involved in a class action lawsuit and the rumor refers to a lawsuit that involved Haynes Investments. Haynes Investments at the time was involved with some casinos being built by Native Americans. “Somewhere around 2007-08 we got involved in financing and consumer lending for the tribes…when Barack Obama got elected in 2008 and the lending became an issue…trial lawyers couldn’t sue the tribes because they are a sovereign nation…so they sued Haynes Investments and other investors.” The case was resolved in Haynes’ favor.

The next question came from a resident who was contacted about the petition circulated to stop funding for the Pier 334 Project. The question stated, “The petition that was taken door-to-door when the woman came to my house, she stated that the petition was to stop the city from loaning money to the developer because Mr. Haynes had a bad credit rating and the lender would not lend him money without this loan. Number one – was I told the truth, Number two – Is it the city or the EDC loaning the money?”

Haynes answered that he has the highest credit rating available through Wells Fargo, unblemished and perfect for a long time. He also said that he is insulted that people would spread lies like that. “The funding is complete. I have two term sheets that I have shared with the EDC and the council…one is from April 22 and the second was from March…for a total of $23 million to finance the project.”

EDC Director Robin Sykora answered that the loan is from the EDC, not the city, adding that it is common for the EDC to do loans of this type and that they have several loans out currently.

The next question concerned delays about this project. Haynes went through the timeline of the project from inception to proposal, adding that the project came directly out of the city’s long-term planning. The project became a public/private partnership with the EDC to give citizens what they stated was missing from Gun Barrel City during the planning sessions open to the public.

Haynes detailed the steps taken to bring the project from a concept to a workable plan including dealing with Henderson County to become part of the PACE program which focuses on improving properties. He went through the choice of Hilton for the hotel, hiring of engineers and architects, feasibility studies, and all it takes to get a project like this off the ground. “It seems like the natural progression for a project like this,” Haynes concluded.

With the meeting turned to public comments and questions, moderator Bob Durant began by saying he wanted to separate rumors and truth and that this meeting was to get out the facts. Kerry Kirksmith addressed the need for improved infrastructure to handle the traffic and requested that the developers give back to the community in terms of helping and staying around after the project is completed. Haynes stated that after two traffic studies, since the hotel has only 60 rooms, there really wasn’t much of an impact. In terms of giving back, Haynes said they have given almost 20% of the land back to public use, including the splash pad that will be open to the public.

Gary Damiano questioned the project cost increase over the period of time the project has been going on and the room rate of over $200 a night. Haynes explained again the evolution of the project from an idea to a Hilton Tapestry Hotel with marina, shopping, restaurants etc. and that the $14 million was an initial idea before the plan was completely formulated along with the cost of reserve requested by the lenders. To the room rate question, he addressed that there really is nothing like it on the lake, a waterfront hotel where a wedding can be held or large events. The other consideration is the rewards members for Hilton Hotels and business events for Walmart or Lowes.

Sykora said that feasibility studies are available for viewing by the public. Many of the public’s questions could be answered by those studies, Sykora said, but since they contain proprietary information, they cannot be duplicated and handed out in meetings, but can be viewed.

Some of the other questions centered around what would happen if the developer defaults such as happened with the Heritage Cove project many years ago. The Heritage Cove development involved the LaQuinta Hotel, shopping center and movie theater and was to include housing and walking trails as well. The EDC’s attorney Moore spoke to how the EDC proceeds in the event of a breach of contract, after assessing that a breach had occurred, that contact would be made not only to the address of the business but also to the principals. Moore also said they could get the property back and he feels that all the safeguards are in place to protect the EDC but in the case of a default, the lenders are always the first in line.

Another speaker brought up the point that in his opinion, Hilton would have done more due diligence than Gun Barrel could ever afford to do before approving the Hilton Tapestry Hotel for this area. He also spoke of Haynes’ contribution to the Trinidad community.

Kate Weller pointed out that all the increase in cost was an increase to YNS Services and Haynes and his investors, not to the EDC. She also asked if the $500,000 loan did go to the voters in November and was turned down, what effect would that have on the projects. With agreements in place, Haynes said that possibly landscaping could be affected. He also pointed out that the loan came about because of the rise in interest rates and was offered by the EDC. He said that if the loan does not come to fruition, the project would go forward. Sykora reiterated that the loan was an incentive and was not requested by Haynes.